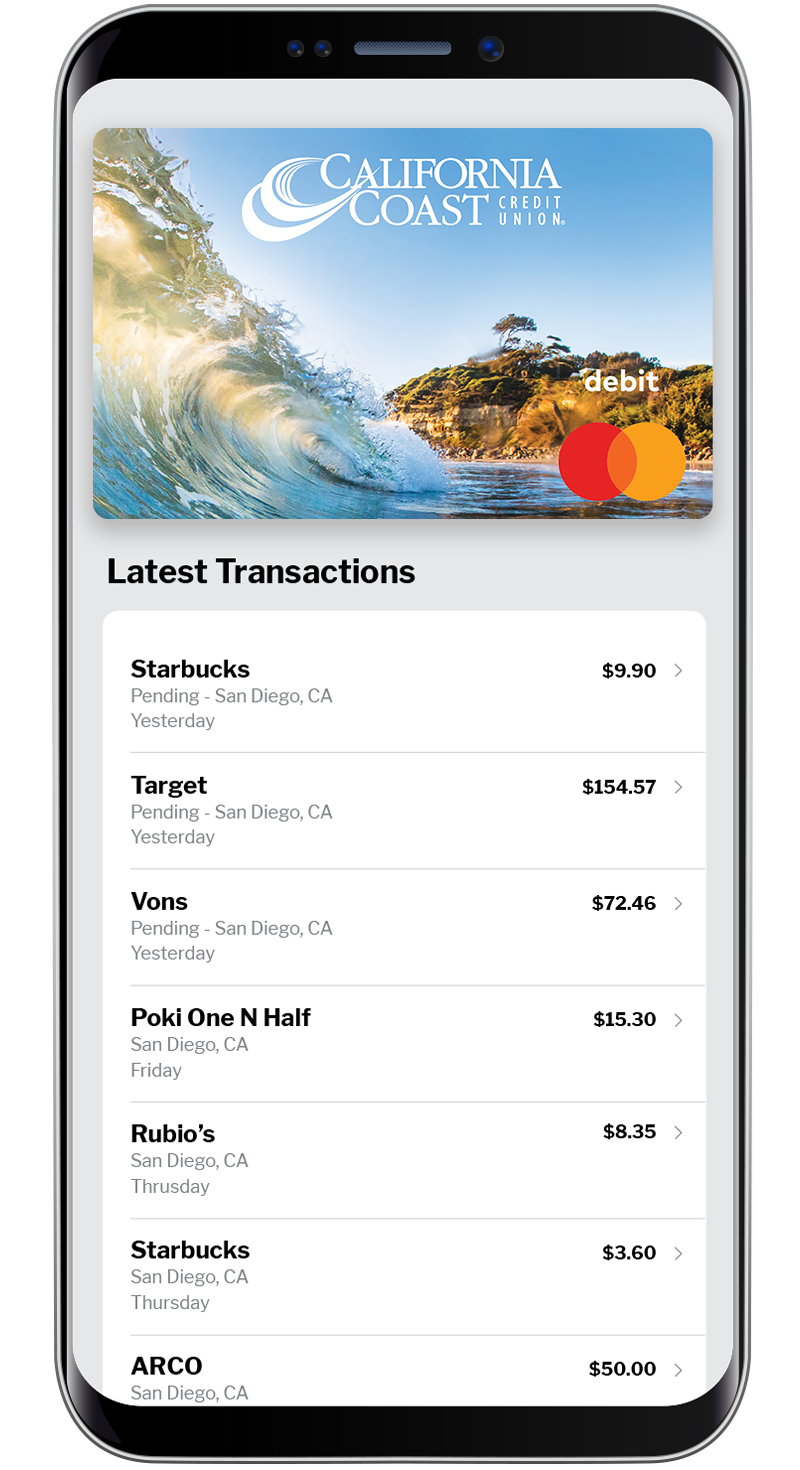

Welcome to California Coast Credit Union

At Cal Coast, our mission is to simplify the lives of our members, provide the highest level of service and ultimately help you achieve financial prosperity. We're proud of our commitment to diversity, equity and inclusion and in our ability to give back to the San Diego, Riverside, Orange, Los Angeles, Ventura, Imperial, and San Bernardino communities.